I generally don’t chortle with joy when I read the Washington Post. This is the newspaper, after all, that often slants the news in ways that irk me.

- Deceptive reporting about Medicaid

- Deceptive reporting about the budget

- Deceptive reporting about Obamacare

- Deceptive reporting about appropriations

- Deceptive reporting about Germany

Though maybe, in one or two instances, I should accuse the paper of sloppiness rather than dishonesty. Regardless, I still shake my head with disdain.

But not today. A recent story about corporate taxation brought a big smile to my face. Here are some passages that warmed my heart.

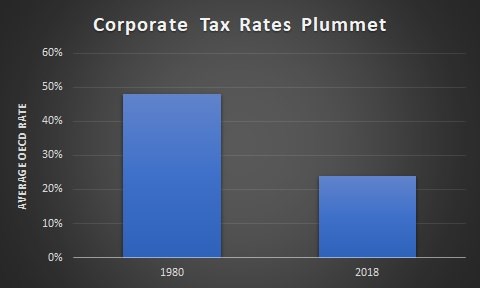

Taxes on corporations are plummeting across the globe… The average corporate tax rate globally has fallen by more than half over the past three decades, from 49 percent in 1985 to 24 percent in 2018, the study found…The international decline in corporate taxes threatens to drain governments of a source of funding for health care and other social welfare programs.

And here are some examples.

Republicans in Congress slashed the U.S. federal corporate tax rate from 35 percent to 21 percent… the United States was joining a crowded party. In Japan and China, corporate tax rates have fallen by about a quarter since 2003. Rates are down about 30 percent over the same period across all of Europe, by 36 percent in Israel and by 27 percent in Canada… Hungary… has lowered its corporate tax rate from 18 percent to 9 percent.

But I’m not happy simply because corporate tax rates are being reduced.

And I’m not smiling just because tax competition is pressuring politicians to do the right thing (though that does send a tingle up my leg).

I’m also overcome with schadenfreude because advocates of bad policy are chagrined by these developments.

“Corporate taxes are going to die in 10 to 20 years at this rate,” Ludvig Wier, an economist at the University of Copenhagen and a co-author of the study, said in an interview. “Without drastic collective action, you can see we’re nearing the end of it.”… academics say the falling tax rates… reflect a race to the bottom… The falling corporate tax rate represents a “collective action problem,” Wier argued, as each country has a strong incentive to lower its own tax rate, although when that is done the globe suffers.

I guess we know Mr. Wier’s perspective. There’s a “collective action problem” and “the globe suffers” because corporate tax rates are falling.

Perhaps he hasn’t read the substantial academic literature showing that lower rates are good for growth?

Fortunately, some academics are focused on measuring the real-world impact of policy changes. Professor Juan Carlos Suárez Serrato of Duke University crunched some numbers for the National Bureau of Economic Research and found that jobs and investment both decline when companies can’t protect their income from government.

... Eliminating firms’ access to tax havens has unintended consequences for economic growth. We analyze a policy change that limited profit shifting for US multinationals, and show that the reform raised the effective cost of investing in the US. Exposed firms respond by reducing global investment and shifting investment abroad—which lowered their domestic investment by 38%—and by reducing domestic employment by 1.0 million jobs. We then show that the costs of eliminating tax havens are persistent and geographically concentrated, as more exposed local labor markets experience declines in employment and income growth for over 15 years.

The moral of the story is that workers and investors benefit when money stays in the private sector.

This means pushing corporate tax rates as low as possible, while also allowing companies to utilize low-tax jurisdictions for their cross-border transactions.

That’s a win-win for the economy, and the angst on the left is a fringe benefit.

I’ll close with this chart I put together showing how the average corporate rate has declined in developed nations.

P.S. Individual rates also have declined since 1980, thanks in large part to the virtuous cycle of tax competition unleashed by Reagan and Thatcher. Sadly, the left has been somewhat successful in curtailing tax havens, and this has given politicians leeway to push tax rates higher in recent years.